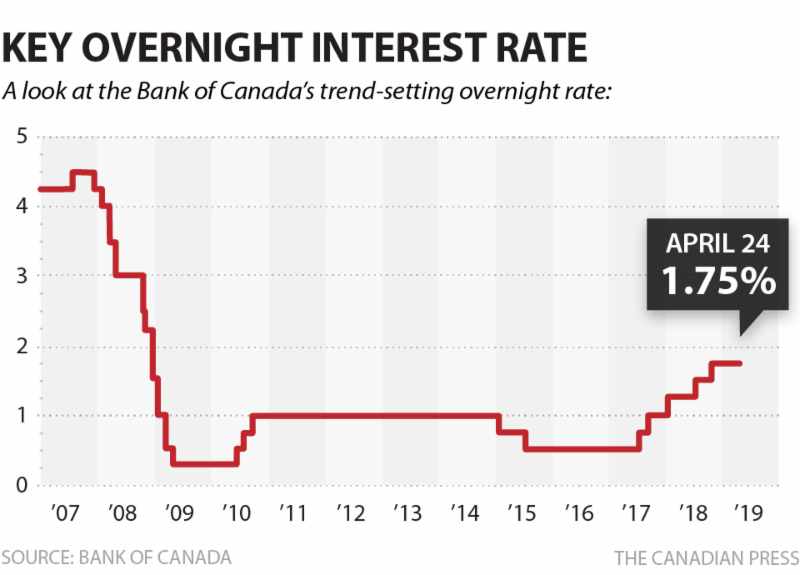

Summary : The Bank of Canada kept its benchmark interest rate at 1.75 per cent on Wednesday. Economists who monitor the bank weren't expecting any change to the rate, which the central bank meets to decide on every six weeks.

Bank of Canada holds interest rate steady, hints low rates could stick around

In January, the bank was expecting Canada's economy to grow by 1.7 per cent this year. On Wednesday, it downgraded that lukewarm forecast to a chillier 1.2 per cent.

Bank of Canada governor Stephen Poloz did add, however, that the bank expects the latter half of the year to be better than the first.

"Right now, we believe that this setting of interest rates will give us the outlook that ... growth picks up in the second quarter, and picks up for real in the third quarter for the second half of the year," he said.

Nonetheless, an economy that's on track to grow by less than the current inflation rate is a recipe for low rates, which is why "an accommodative policy interest rate continues to be warranted," the bank said.

The central bank's rate impacts Canadians by influencing the rates that retail banks give to savers and borrowers on products like mortgages and savings accounts.